Table of contents

- Introduction

- A Trusted Capital Allocation Layer

- The Challenges Faced

- The Solution: Meteora Dynamic Vaults

- Benefits for Users and the DeFi Ecosystem: Empowering Users and Fostering Growth

- Capital Efficiency through Dynamic Allocation: Maximizing Your Money's Dance Moves

- Composability across Different Protocols and DApps: Grooving to the Rhythm of Interoperability

- Automatic Capital Allocation: Letting Hermes Do the Heavy Lifting

- Mitigating Risks and Ensuring Safety: Protecting Your Assets, No Tango with Danger

- Case Study: How Dynamic Vaults Helped Save LP Capital during the Solend.fi USDH Exploit

- Unleashing the Power of AMM Pools: A Deeper Dive

Introduction

Meteora Dynamic Vaults is a revolutionary concept in the world of decentralized finance (DeFi). Designed to provide users with optimal yield opportunities while ensuring the safety and accessibility of their funds, Meteora's Dynamic Vaults offer a dynamic yield infrastructure that continuously rebalances across lending platforms. In this blog post, we will explore the key features of Meteora's Dynamic Vaults, the challenges they address, and the benefits they bring to the DeFi ecosystem.

Didn't you get it? Well wait I can explain you better

Imagine you have a piggy bank, but it's not an ordinary piggy bank. It's like a magical piggy bank that can make your money grow while keeping it safe. That's what Meteora Dynamic Vaults are like in the world of decentralized finance!

These special vaults help people like you find the best ways to grow their money. They do this by constantly checking different places where you can lend your money and earn more in return. It's like finding the best candies in different candy stores!

But there's something even more amazing about these vaults. They are super smart and always keep your money safe. They have special rules to make sure your money goes to trusted places and doesn't get lost. It's like having a guardian angel for your money!

Meteora's Dynamic Vaults also help the whole DeFi world to grow and become better. They attract more people and more money to join in the fun of lending and earning. It's like having more friends to play with and more toys to share!

So, in simple words, Meteora's Dynamic Vaults are like magical piggy banks that help you grow your money while keeping it safe. They make sure you find the best places to lend your money and have fun while doing it. And they also help the whole DeFi world to grow and become even more exciting!

A Trusted Capital Allocation Layer

In the realm of DeFi, having a trusted capital allocation layer is essential. Meteora Dynamic Vaults prioritize user funds and employ a minute-by-minute rebalancing mechanism across lending platforms. This dynamic approach ensures that users can benefit from the best possible yield opportunities while keeping their funds accessible.

The Challenges Faced

Users often face challenges when it comes to monitoring their funds and optimizing yields. They may not have all the necessary information to determine which lending protocols offer the most optimal yields. Additionally, reacting quickly to unexpected events, especially when offline, can be difficult, leading to missed opportunities or potential losses.

Protocols, wallets, and treasuries also encounter challenges in optimizing their assets for yield. Aggregating the most optimal yield opportunities can be complex and time-consuming, resulting in missed chances to generate higher returns. Moreover, protocols may resort to unsustainable methods, such as offering their own tokens as rewards to attract liquidity providers.

The Solution: Meteora Dynamic Vaults

Meteora's Dynamic Vaults present an innovative solution to address these challenges. These vaults integrate with multiple lending protocols, creating an end-to-end risk management framework that optimizes yield, mitigates risks, and maintains full principal liquidity.

Through real-time yield optimization, Meteora dynamically searches for the best yield opportunities across connected lending protocols. By continuously monitoring lending pool utilization rates and protocol reserves, Meteora ensures the safety of deposited funds. When predetermined thresholds are reached, funds are automatically withdrawn, safeguarding users' assets.

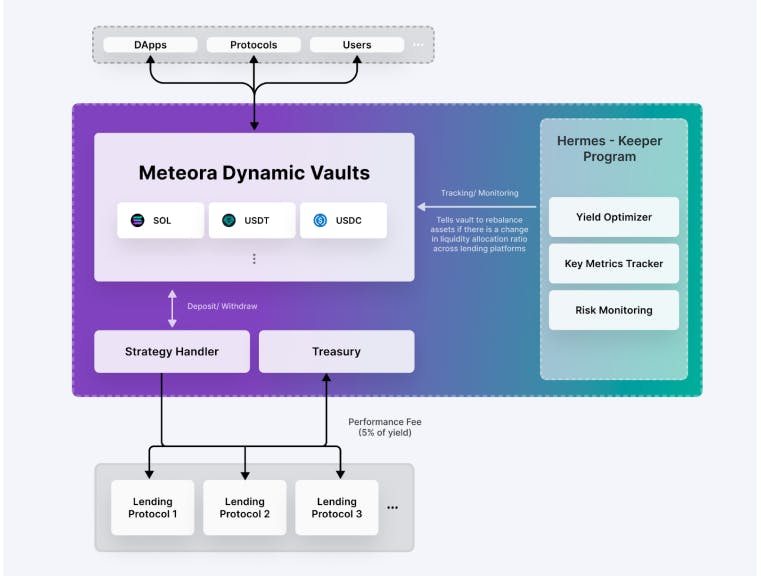

Let's break down the system's three main components :

Vault: The Vault is like your personal safety, but with a twist. It holds your single-token assets, such as USDC or SOL, in a cosy and secure manner. It's like having a special pocket in your jacket for your favourite candy bar. And guess what? The Vault doesn't discriminate – it welcomes assets from different sources, like an AMM and a wallet, into its warm embrace. You can deposit liquidity into the Vault through a user-friendly interface, making it a breeze to stash away your digital treasures.

Keeper - Hermes: Meet Hermes, the off-chain keeper and guardian of the Dynamic Vaults. Hermes is like the wise old owl, constantly monitoring and calculating to keep things running smoothly. It's the brain behind the operation, handling complex tasks like monitoring lending protocols and optimizing liquidity allocations. Hermes knows the secret recipe for the most delicious yield opportunities. It does the math and sends a rebalance crank to the Vault, ensuring that deposits and withdrawals happen at just the right time. It's like having a personal financial advisor who always has your back.

SDK Module (Integration APIs): The SDK module is like a magical toolbox filled with pre-built modules and code samples. It's your ticket to the world of integration with the Dynamic Yield Layer. With the SDK in hand, decentralized applications (DApps) and protocols, like AMMs and wallets, can easily join the party. It's like having a DJ booth where everyone can plug in their own tunes. Through simple API calls, liquidity can be deposited into or withdrawn from the Vaults, creating a harmonious dance between different protocols. The yield generated by the Vaults can then be distributed back to the liquidity providers, making it a win-win for everyone on the dancefloor.

So, imagine a world where your assets groove to the beat of the Meteora Dynamic Vaults, where deposits and withdrawals are as smooth as a jazz saxophone solo. With a touch of humour and a sprinkle of charm, the system's components come together to create a symphony of convenience and opportunity.

Benefits for Users and the DeFi Ecosystem: Empowering Users and Fostering Growth

Meteora's Dynamic Vaults offer several key benefits to users and the broader DeFi ecosystem. For users, the constant rebalancing and optimization of funds provide a hassle-free way to maximize yield, even when they are unable to actively monitor their investments. The accessibility and security of funds are prioritized, allowing users to have peace of mind.

In the DeFi ecosystem, Meteora's Dynamic Vaults attract more capital and participants by offering a trusted and optimized approach to DeFi lending. By removing the burden of yield optimization and risk assessment from liquidity holders, Meteora enables greater focus on core competencies, driving innovation and growth within the ecosystem.

Capital Efficiency through Dynamic Allocation: Maximizing Your Money's Dance Moves

Dynamic Vaults have a secret dance routine to make your idle capital bust some moves. With their advanced algorithms, these vaults are like smooth choreographers, constantly monitoring and calculating yield variations across lending platforms. They dynamically reallocate assets to the platform with the highest returns, ensuring that your deposited capital becomes a lean, mean yield-generating machine.

Composability across Different Protocols and DApps: Grooving to the Rhythm of Interoperability

Dynamic Vaults have some serious dance skills when it comes to playing nicely with other protocols and dApps. They effortlessly blend into the dance floor of the DeFi world, integrating with various lending protocols on Solana. Like the life of the party, Dynamic Vaults act as lending aggregators, spreading liquidity and bringing the beats to different protocols. You can now maximize your yield potential without breaking a sweat, tapping into a diverse range of lending activities without manual monitoring.

Automatic Capital Allocation: Letting Hermes Do the Heavy Lifting

Dynamic Vaults have their own backstage wizard, Hermes, taking care of the nitty-gritty details. Hermes is the maestro behind the scenes, performing complex calculations and monitoring lending protocols. It's like having a backstage manager who ensures the dancers are in perfect sync. By keeping an eye on deposit APY, utilization rates, and liquidity in pools, Hermes ensures that your capital is automatically allocated to the highest-yielding moves on the dance floor.

Mitigating Risks and Ensuring Safety: Protecting Your Assets, No Tango with Danger

Dynamic Vaults take your safety seriously, just like a dance partner who knows all the right moves. Your funds are held in trusted and decentralized protocols, ensuring they are well-protected. The keeper program, Hermes, can't touch your funds or claim your principal. It's like having a trusty dance partner who will never step on your toes. Plus, risk monitoring services keep an eye on utilization rates and reserve levels. If things get too risky, liquidity is swiftly withdrawn to keep your assets safe from any dancefloor mishaps.

So, get ready to watch your idle capital show off its best dance moves with Dynamic Vaults. They optimize your capital allocation, blend seamlessly with different protocols, and ensure your assets stay safe while generating impressive yields. It's time to let your money boogie to the rhythm of financial success!

Disclaimer: No actual dance skills are required to participate in the world of Dynamic Vaults.

Introducing Hermes - The Magical Money Manager of Meteora Dynamic Vaults

Now, let's meet Hermes, the off-chain keeper program that makes sure your money is always in the right place at the right time. Hermes is like a magical money manager who knows all the tricks to optimize your yield and protect your funds from risks. It's a wizard behind the scenes, working hard to find the best ways to grow your money.

Hermes has a special algorithm that helps it find the most optimal yield allocations. It's like a secret recipe that breaks down your money into small portions and simulates deposits in different lending platforms. It then compares the Annual Percentage Rate (APR) of each platform and picks the one with the highest APR for each portion. By doing this dance of deposits and withdrawals, Hermes discovers the perfect balance to maximize your yield.

But Hermes doesn't stop there! It also knows when to do a rebalance crank. This crank is like a magical tool that adjusts the allocation of your money if it differs by more than 0.1%. It's like a DJ who knows how to mix the beats to keep the party going smoothly.

Now, let's talk about the rebalancing process. After each rebalance, Hermes claims the yield from the lending platforms, adding it to the total amount of your vault. It's like collecting extra coins and adding them to your piggy bank. This process happens regularly, every few minutes, to make sure your money keeps growing.

So, in simple words, Hermes is like a magical money manager who knows how to find the best places to grow your money. It uses a secret algorithm to optimize your yield and does rebalancing dances to keep everything in check. With Hermes by your side, your money is in good hands, and you can sit back, relax, and watch it grow like magic!

Disclaimer: No actual magic is involved in the process, but Hermes does a fantastic job at managing your money!

Case Study: How Dynamic Vaults Helped Save LP Capital during the Solend.fi USDH Exploit

The Solend.fi USDH Exploit

On November 2nd, 2022, an exploiter executed an oracle attack on Saber, inflating the price of the USDH stablecoin. As a result, assets were drained from Solend's isolated pools, including the Stable, Coin98, and Kamino pools, resulting in $1.26 million in bad debt. Although Dynamic Vaults did not directly support USDH assets, it was still exposed to the exploit due to its holdings of UXD assets in the Stable and Coin98 pools on Solend.

Problems Faced by LPs

LPs who had allocated their funds to the affected pools faced the risk of losing their capital due to the exploit. The sudden drain of assets and the resulting bad debt posed a significant threat to LPs' investments.

Impact and Response

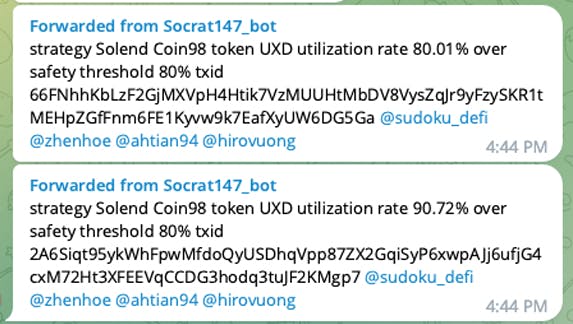

The safety mechanisms built into Dynamic Vaults proved to be instrumental in mitigating the impact of the exploit. The keeper program, Hermes, continuously monitored the utilization rates of the pools and detected the high utilization of over 80% in both the Stable and Coin98 pools. Immediately recognizing the risk, a withdrawal request was sent, and all UXD assets were swiftly withdrawn back to the Dynamic Vaults before the pools were fully drained.

Fig: Keeper report of Solend utilization rate.

Remarks and Efficacy

The prompt action taken by Hermes to withdraw 100% of the UXD liquidity from Solend back to the Dynamic Vaults proved to be highly effective in protecting LP capital. By swiftly detecting the exploit and withdrawing the assets, Dynamic Vaults prevented any lock-up of user funds in Solend and safeguarded LPs from losses.

Unleashing the Power of AMM Pools: A Deeper Dive

Let's take a deeper look at how Meteora's Dynamic Vaults can revolutionize Automated Market Maker (AMM) pools and unlock their full potential for liquidity providers (LPs).

Currently, a significant portion of assets in AMM pools remains unutilized, resulting in suboptimal yield generation. This limited utilization makes it challenging to attract LPs, as the returns they earn may not be compelling enough. To address this issue, many projects resort to continuous Liquidity Mining (LM) programs, which reward LPs with additional tokens. However, such programs can be unsustainable in the long run.

Enter Meteora's Dynamic Vaults, the game-changer for AMM pools. By integrating AMMs with the Meteora yield layer infrastructure, we create a powerful ecosystem that maximizes capital efficiency and yield opportunities.

Let's consider a specific example: a stable pool consisting of USDC and USDT tokens. Here's how the magic unfolds:

As LPs deposit their USDC and USDT tokens into the AMM pool, these tokens are swiftly transferred to the corresponding vaults within the Meteora infrastructure layer. This step ensures that the funds are securely managed and ready for optimization.

The USDC and USDT vaults reserve a small portion, let's say 10%, of the liquidity to facilitate immediate token swaps or withdrawals by the connecting AMMs. This ensures seamless accessibility for users.

Now comes the exciting part. The remaining 90% of tokens in the vaults are strategically allocated across multiple lending platforms. For instance, the USDC vault may distribute 90% of its tokens among platforms like Port Finance, Solend, Mango, and others. By doing so, the vault actively participates in lending activities, earning additional yield for LPs.

To ensure LPs always enjoy the best returns, the yield optimizer closely monitors and dynamically adjusts the allocation of liquidity across the different platforms. By rebalancing every few minutes, the yield optimizer optimizes the yield generation for LPs, capturing the ever-changing landscape of lending opportunities.

With this approach, the once dormant tokens within the AMM pools spring to life, actively flowing and generating returns through the Meteora yield layer. The result is a highly efficient capital utilization system, where LPs can enjoy superior yield opportunities and a more compelling return on their investments.

By envisioning the dynamic vaults as the backbone of Solana's yield layer infrastructure, Meteora empowers individuals to harness the true potential of their assets. AMM pools become vibrant hubs, attracting more LPs and fostering a thriving ecosystem of liquidity and growth.

Conclusion

In a nutshell, Meteora's Dynamic Vaults are the superheroes of the DeFi world. They optimize your capital allocation, generate high yields, and provide LPs with an unforgettable investment experience. With their advanced algorithms and automated rebalancing, these vaults make sure your money is always working hard for you.

Gone are the days of idle assets and missed opportunities. Meteora's Dynamic Vaults bring life and excitement to AMM pools, transforming them into vibrant hubs of liquidity and profitability. They enable LPs to tap into the full potential of their assets while keeping things simple and user-friendly.

No more FOMO or constant monitoring is required. The vaults handle the nitty-gritty of yield optimization, so you can sit back, relax, and let your money do the heavy lifting. And with the added layer of security and risk mitigation, you can trust that your funds are in safe hands.

Meteora's vision extends beyond individual investors. They aim to revolutionize the entire DeFi ecosystem, attracting more capital, driving innovation, and fostering growth. It's a win-win for everyone involved.

So, whether you're a seasoned investor or just dipping your toes into the world of DeFi, Meteora's Dynamic Vaults are your ticket to a more profitable and hassle-free experience. Get ready to unlock the full potential of your assets and join the exciting journey towards a brighter financial future.

References:

Meteora Dynamic Vaults Whitepaper:https://docs.meteora.ag/liquidity-primitives/dynamic-vaults/dynamic-vaults-whitepaper

Solend Exploit: https://twitter.com/solendprotocol/status/1587671511137398784?s=20&t=7H-bfCdfCUbI_W0pn5Gyww

Meteora Docs: https://docs.meteora.ag/liquidity-primitives/dynamic-vaults